Unlock Financial Peace with Expert Accounting and Bookkeeping Services

- Home

- Services

- Accounting and Bookkeeping

Every successful business owner knows that robust financial management is the bedrock of sustainable growth. Yet, the complex, time-consuming tasks of managing ledgers, reconciling accounts, and navigating ever-changing tax laws can divert your energy from core business operations.

At Prime Tax Solutions, we provide comprehensive, end-to-end accounting and bookkeeping services designed to transform your financial function from a stressful burden into a powerful strategic asset. We don’t just record numbers; we deliver clarity, compliance, and actionable insights that drive profitability.

Stop losing sleep over audits and messy spreadsheets. Partner with our team of chartered professionals and leverage precise financial data to make confident decisions. It’s time to gain total control over your business’s financial health, backed by a team committed to your success.

Comprehensive Accounting and Bookkeeping Services Tailored for Your Success

We offer a modular, scalable suite of accounting and bookkeeping services that adapt perfectly to the needs of startups, growing SMEs, and established corporations. Our integrated approach ensures every financial detail is captured, analyzed, and leveraged for maximum benefit, ensuring you always have a real-time, accurate picture of your business’s fiscal standing.

Full-Service Bookkeeping: The Foundation of Financial Health

Our full-service bookkeeping solution goes far beyond simple data entry. It is the meticulous, systematic handling of all your daily financial transactions, providing the reliable data necessary for strategic decision-making and flawless tax preparation.

Systematic Transaction Recording & General Ledger Management: We ensure every sale, purchase, and expense is categorized correctly and posted to the general ledger. This detailed, accurate record-keeping minimizes end-of-year stress and makes financial reporting effortless.

Accounts Payable (A/P) Management: We streamline your vendor payments, managing invoices, tracking due dates, and ensuring you capitalize on any early payment discounts while avoiding late fees. Efficient A/P protects your cash flow and strengthens vendor relationships.

Accounts Receivable (A/R) Management: Fast, efficient invoicing and collection are critical. We manage your A/R process, from generating and sending professional invoices to following up on overdue payments, drastically improving your cash conversion cycle.

Bank and Credit Card Reconciliation: This crucial step ensures every transaction recorded in your books matches your bank statements. Our regular reconciliation process identifies errors, unauthorized transactions, and discrepancies immediately, guaranteeing the accuracy required for successful audits and reporting.

Strategic Financial Reporting and Analysis

Accurate data is useless without interpretation. Our accounting and bookkeeping services include producing and analyzing key financial statements, transforming raw data into powerful business intelligence.

Preparation of Core Financial Statements: We generate the three critical statements that define your financial position:

Income Statement (P&L): See your revenue, costs, and profit/loss over a specific period.

Balance Sheet: Understand your assets, liabilities, and owner’s equity at a snapshot in time.

Cash Flow Statement: Track the movement of cash, highlighting liquidity and operational efficiency.

Customized Financial Reporting (KPIs): We work with you to identify the Key Performance Indicators (KPIs) most important to your industry and business model. Whether it’s gross profit margin, customer acquisition cost, or burn rate, we deliver targeted reports monthly or quarterly to keep you focused on actionable metrics.

Budgeting, Forecasting, and Variance Analysis: Planning for the future is impossible without precise historical data. We use your meticulous bookkeeping records to help you build realistic budgets and financial forecasts, and then perform variance analysis to explain where your actual performance deviated from the plan.

Seamless Payroll Management and Compliance

Handling payroll in Canada involves intricate calculations, strict deadlines, and zero tolerance for error regarding statutory withholdings and remittances. Our payroll component ensures your team is paid accurately and on time, every time.

Wage Calculation and Deduction Management: We handle the complex calculations for gross wages, taxable benefits, mandatory deductions (CPP, EI, Income Tax), and employer contributions, ensuring total accuracy and compliance.

Remittance Filing: We ensure timely and accurate remittances of source deductions (PD7A) to the Canada Revenue Agency (CRA), protecting you from penalties and interest.

T4 and T4 Summary Preparation: At year-end, we handle the preparation and distribution of T4 slips for your employees and the T4 Summary for the CRA, a seamless extension of our robust accounting and bookkeeping services.

Deep Dive into the Benefits of Professional Accounting and Bookkeeping Services

Choosing to outsource your financial management is not merely an expense; it is a vital investment that yields substantial returns in time, compliance, and strategic capability.

Maximize Profitability Through Financial Insight

With our services, you move beyond simply tracking your finances to actively optimizing them. Detailed financial reports allow you to identify high-margin services, pinpoint hidden costs, and make informed decisions on capital expenditure. We provide the rearview mirror and the roadmap simultaneously, giving you a competitive edge. You will understand precisely where every dollar is earned and spent, ensuring maximum returns.

Guarantee Compliance and Eliminate Audit Risk

Canadian tax and labor laws are constantly evolving. Staying compliant is a full-time job. Our professionals specialize in Canadian tax regulation (CRA and provincial laws). By using our accounting and bookkeeping services, you ensure that:

Tax Deadlines are Never Missed: All necessary filings, including GST/HST/QST returns, payroll remittances, and corporate taxes, are prepared accurately and submitted on time.

Records are Audit-Ready: Should the CRA call, your complete, organized, and compliant financial records are ready to go, significantly reducing the stress and potential liabilities associated with an audit.

Tax Liabilities are Minimized: Accurate categorization and expense tracking ensure you claim every legitimate deduction and credit, legally minimizing your annual tax burden.

Free Up Your Time to Focus on Core Business Activities

Your expertise lies in serving your customers and leading your team—not in complex financial reconciliation. By offloading the operational burden of bookkeeping and accounting to us, you reclaim dozens, if not hundreds, of hours per year. This time can be redirected to sales, innovation, product development, and staff training, accelerating your business growth.

Why Prime Tax Solutions is Your Best Partner for Accounting and Bookkeeping Services

We know you have a choice when it comes to financial partners. Prime Tax Solutions distinguishes itself not just through the breadth of our accounting and bookkeeping services, but through our unwavering commitment to client trust, local expertise, and measurable results.

Decades of Experience and Local Expertise

Our team is composed of seasoned professionals—Chartered Accountants (CAs) and Certified Public Bookkeepers (CPBs)—with decades of combined experience serving businesses across various industries, from manufacturing and retail to professional services and e-commerce.

Canadian Tax Mastery: We are specialists in the Canadian financial landscape, ensuring that your books are always compliant with both federal and provincial legislation. This local expertise is crucial for complex areas like GST/HST filing and provincial labor standards.

Technology-Forward Approach: We leverage industry-leading software (QuickBooks Online, Xero, Sage) and cloud-based platforms to deliver services efficiently, securely, and in real-time, allowing for instant collaboration and data access.

Our Triple Guarantee: Accuracy, Compliance, and Timeliness

We stand by the quality of our work with three core assurances:

The Accuracy Guarantee: We guarantee the mathematical accuracy of all financial statements and reconciliations prepared by our team. If an error is found, we will fix it immediately at no additional cost.

The Compliance Guarantee: We guarantee that all payroll remittances and tax filings we prepare will be compliant with current CRA standards, provided all necessary information is supplied by the client.

The Timeliness Guarantee: We commit to delivering your scheduled monthly reports and financial statements on time, enabling you to meet your internal deadlines and make critical decisions promptly.

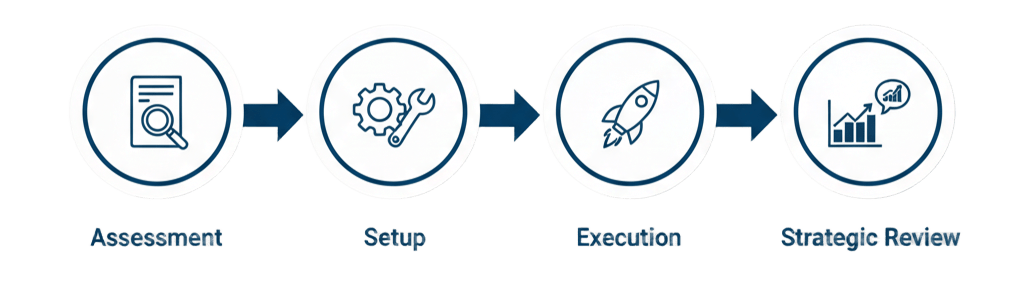

Our Simple 4-Step Process for Implementing Accounting and Bookkeeping Services

We believe the process of transitioning to professional accounting and bookkeeping services should be seamless and stress-free. Our proven four-step method ensures a smooth integration and immediate financial improvement.

1. Initial Financial Assessment and Custom Strategy

The process begins with a confidential, in-depth consultation. We review your current financial state, assess your existing systems, analyze your industry requirements, and discuss your specific business goals (e.g., expansion, securing financing, maximizing exit value). Based on this, we draft a customized service agreement outlining the exact suite of accounting and bookkeeping services that will best serve your enterprise.

2. Seamless Data Migration and System Setup

Our team manages the entire transition. We handle the migration of your historical data, set up the chosen cloud accounting platform (e.g., QuickBooks Online), and establish secure access protocols. We integrate our systems with your existing platforms (POS, CRM, inventory management) to ensure automatic data flow, creating a unified and efficient financial ecosystem from day one.

3. Ongoing Daily Bookkeeping and Monthly Reporting

This is where the transformation happens. On a daily and weekly basis, our team diligently:

Categorizes transactions and records expenses.

Performs bank and credit card reconciliations.

Manages A/P and A/R.

Processes payroll and manages remittances. At the close of each month, we generate and deliver your customized financial reports, providing you with a clear, concise summary of your performance and key metrics.

4. Strategic Review and Year-End Tax Optimization

Our service is consultative, not just transactional. Quarterly, we schedule a review meeting to discuss your financial statements, explain variances from your budget, and offer strategic advice on optimizing cash flow and profitability. When year-end arrives, the groundwork laid by our meticulous accounting and bookkeeping services makes tax preparation fast, efficient, and fully optimized for tax minimization.

Frequently Asked Questions About Our Accounting and Bookkeeping Services

Q1: What is the difference between accounting and bookkeeping services?

Accounting and bookkeeping services are complementary but distinct. Bookkeeping is the process of recording and organizing daily financial transactions (data entry, payroll, invoice management). Accounting takes that organized data and interprets it, producing financial reports, performing analysis, preparing tax returns, and offering strategic financial advice. Our firm offers both, providing a seamless financial solution.

Q2: Is my data secure when using your cloud-based accounting and bookkeeping services?

Absolutely. Data security is our highest priority. We utilize bank-grade encryption and multi-factor authentication on all cloud platforms (e.g., QuickBooks Online, Xero). All client information is stored and managed in compliance with strict Canadian privacy laws. You maintain full ownership and control of your financial data at all times.

Q3: How do you handle my company’s sales tax (GST/HST/QST)?

Our accounting and bookkeeping services include the accurate calculation, reconciliation, and timely filing of all required sales tax returns (GST/HST/QST). We ensure that you claim all eligible Input Tax Credits (ITCs) and Input Tax Refunds (ITRs) while remaining compliant with federal and provincial tax authorities, saving you time and ensuring you avoid penalties.

Q4: My current books are a mess. Can you still help?

Yes, absolutely. One of our most common engagements involves a “Clean-Up” service. We will dedicate a team to reconcile and correct historical errors, categorize backlog transactions, and bring your books up-to-date and compliant. This is the essential first step before implementing ongoing accounting and bookkeeping services.

Q5: How often will we communicate?

Communication frequency is tailored to your package, but at minimum, you will receive a monthly report package and have access to your dedicated account manager via email and phone. Clients on our Growth and Enterprise packages receive structured quarterly or monthly review meetings to discuss strategic financial performance.

The Strategic Advantage of Integrated Financial Management

The commitment to delivering exceptional accounting and bookkeeping services is a commitment to your company’s future. By integrating all financial functions—from daily transaction recording and payroll to complex reporting and tax planning—under one expert roof, we eliminate silos, improve data integrity, and provide a single, consistent source of truth for all your financial decisions.

We help you leverage financial metrics to identify opportunities for expansion, manage capital efficiently during periods of high growth, and stabilize cash flow during slower cycles. Our goal is to ensure you not only survive but thrive in the competitive Canadian market.

This partnership is about more than just compliance; it’s about providing the confidence to grow. We manage the details so you can manage the vision. Don’t let disorganized books or missed deadlines stifle your potential.