Expert CRA Audit Assistance: Protect Your Future with Confidence

- Home

- Services

- Audit Assistance

The moment you receive a notice from the Canada Revenue Agency (CRA) indicating an audit, a wave of anxiety, confusion, and fear can set in. You are suddenly faced with the daunting task of navigating complex tax laws, gathering years of financial documents, and negotiating with government officials. This is not a task for the faint of heart, nor should it be faced alone.

At PrimeTax Solutions, we understand the immense pressure and the significant financial risk involved. That’s why we specialize in providing premier, professional CRA audit assistance designed to take the burden completely off your shoulders. We transform a stressful, intrusive process into a structured, manageable defense of your financial standing. Our expert team stands between you and the CRA, ensuring your rights are protected, your documentation is flawless, and you achieve the most favorable outcome possible.

Don’t let the CRA dictate your financial future. When the stakes are high, you need proven expertise. Discover how our dedicated CRA audit assistance can safeguard your business, your wealth, and your peace of mind.

The Ultimate Guide to Professional CRA Audit Assistance

A CRA audit is more than just a review; it is an official examination designed to verify your compliance with Canada’s tax laws. The scope can range from a simple review of specific deductions to a full, in-depth analysis of your entire business or personal financial history. Without specialized CRA audit assistance, the complexity of the audit process can easily overwhelm even the most organized individuals or businesses, often leading to unnecessary reassessments and costly penalties.

We define professional CRA audit assistance as a comprehensive, end-to-end service where our certified tax professionals handle every facet of the audit on your behalf. This includes initial contact, document preparation, direct negotiations, and, if necessary, formal appeals. Our objective is clear: to minimize your tax liability, reduce or eliminate penalties, and ensure the entire process is resolved as quickly and efficiently as possible.

Understanding the Scope of Your CRA Audit Assistance Needs

CRA audits are not a one-size-fits-all situation. The type of audit you face dictates the specific expertise required. Our CRA audit assistance covers all major categories:

Personal Income Tax Audits

These audits often focus on specific items like rental income and expenses, eligible donations, medical expenses, support payments, or business investment loss claims. A personal audit, while seemingly small, can quickly escalate if the CRA is not satisfied with the documentation. We organize your personal records to present an airtight case, defending every claim you have made.

Corporate and Business Audits

For small and medium-sized enterprises (SMEs), a corporate audit is far more intrusive. It can involve a detailed scrutiny of sales records, cost of goods sold, payroll, capital cost allowance, and corporate tax credits. Our team understands business finances and provides targeted CRA audit assistance to limit the scope of the inquiry, coordinate all logistics (on-site or office review), and ensure business continuity is maintained.

GST/HST Audits (Sales Tax)

Sales tax audits often involve validating input tax credits (ITCs) and input tax adjustments (ITAs). These audits require specialized knowledge to correctly verify tax application and ensure you are claiming all eligible amounts while properly remitting taxes collected. Errors here can result in immediate, large assessments. Our experts ensure your sales tax compliance is impeccable under audit scrutiny.

Key Indicators That You Need Immediate CRA Audit Assistance

Waiting until the last minute can severely limit your defense options. You should seek immediate CRA audit assistance if you receive any of the following documents:

A Pre-Assessment Review (PAR) or Review Letter: While not a full audit, this is the first indication the CRA is questioning specific claims. Early intervention is critical.

A Formal Notice of Audit: This letter clearly states the period under review and the scope (e.g., income, GST/HST, payroll). This is the signal to halt all direct communication and engage representation.

A Requirement to Provide Information (RPI): The CRA is requesting specific documentation. Our team will review the request and provide only the required, properly organized documents.

A Notice of Reassessment: This is the most urgent signal. The CRA has concluded its review and issued a new tax bill, often with significant penalties and interest. We immediately initiate the objection and appeal process.

By engaging us early, you prevent missteps, ensure accurate and complete document submission, and immediately establish a professional barrier between yourself and the auditor, dramatically improving your outcome.

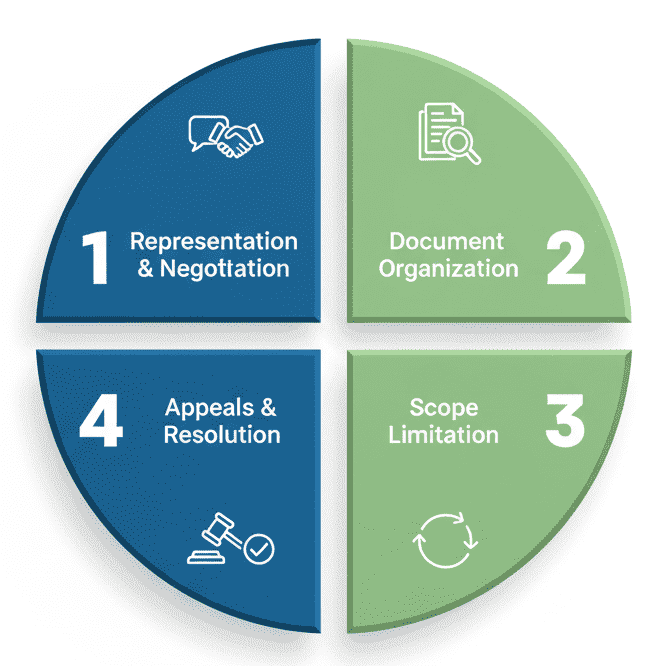

Our Comprehensive CRA Audit Assistance Features & Benefits

When you choose PrimeTax Solutions, you gain a dedicated, multi-layered defense strategy. Our service is built on decades of experience successfully resolving the most complex audit cases across Canada. We don’t just process paperwork; we strategize, negotiate, and advocate fiercely for your rights.

Expert Representation: Dealing with the CRA on Your Behalf

The number one benefit of our CRA audit assistance is the removal of the personal stress and time commitment associated with the audit.

Benefit 1: Zero Direct Contact: We become the sole point of contact for the CRA. All correspondence, emails, and phone calls are routed through our office. You no longer have to spend hours dealing with an auditor or worrying about saying the wrong thing.

Benefit 2: Professional Negotiation: CRA auditors are trained negotiators. Our team is composed of tax professionals, accountants, and former government personnel who understand the CRA’s internal guidelines, policies, and procedural loopholes. We speak their language, allowing us to negotiate fairer terms, extended deadlines, and, most importantly, lower assessments.

Benefit 3: Full Explanations of Your Rights: You have rights as a taxpayer. We ensure the CRA respects procedural fairness, doesn’t overstep its boundaries, and limits its inquiry to the necessary scope.

Meticulous Documentation and Organization for a Strong Defense

The success of any audit defense hinges on the quality and organization of the evidence. We take a proactive approach to turn your disorganized files into a compelling defense package.

Document Gathering: We systematically collect and review all essential business and personal documents, including ledgers, invoices, receipts, contracts, bank statements, and electronic records.

Case File Assembly: Our team organizes and indexes the documents, building a clear, narrative-driven case file that directly addresses the auditor’s concerns, anticipates counter-arguments, and supports every deduction and claim you’ve made.

Efficiency and Delay Minimization: Our active and efficient involvement throughout the document submission phase ensures the audit moves forward smoothly and swiftly, minimizing prolonged disruptions to your life or business operations.

Audit Scope Negotiation and Limitation

A common tactic in auditing is to expand the scope of the review once initial issues are identified. This is where professional CRA audit assistance proves invaluable.

Limiting Inquiry: We challenge overly broad or irrelevant document requests, negotiating with the auditor to focus the review solely on the areas outlined in the initial audit notification.

Convenience Coordination: We coordinate all audit logistics, including scheduling meetings at convenient times and negotiating the location (e.g., our secure office instead of your business premises) to protect your privacy and reduce interference with your day-to-day operations.

Appeals and Dispute Resolution for Unfavorable Decisions

If an audit concludes with a reassessment you believe is unfair, the battle is far from over. We are prepared to take your case to the next level.

Notice of Objection: We file a Notice of Objection on your behalf, initiating the formal dispute resolution process with the CRA Appeals Division. This is handled by a separate division, offering a fresh, objective review of your case.

Formal Dispute Resolution: Our team handles all negotiations and submissions to the Appeals Officer. We prepare detailed legal arguments, relying on case law and specific tax statutes to support your position.

Tax Court Representation: If resolution is not achieved at the Appeals Division level, we can guide and assist you with the final, formal steps of taking your case to the Tax Court of Canada, ensuring you have experienced counsel every step of the way.

Why PrimeTax Solutions is Your Trusted Partner for CRA Audit Assistance (Why Choose Us)

Choosing the right firm for your CRA audit assistance is the most critical decision you will make following an audit notice. At PrimeTax Solutions, our commitment goes beyond competence—it is a commitment to conversion, trust, and the best possible outcome for you.

Unmatched Experience in Complex CRA Audit Assistance Cases

Our team is comprised of seasoned tax experts, many of whom have worked within the tax regulatory environment, giving us unique, insider knowledge of how the CRA operates, what triggers their interest, and the exact evidence they require to close a file favorably.

Specialized Knowledge: We are not general accountants. We are specialists in tax defense and resolution. Our expertise is focused exclusively on Canadian tax law, minimizing compliance gaps, and leveraging every legal strategy available.

Proven Track Record: We have successfully defended hundreds of individuals and SMEs against high-stakes audits involving income tax, corporate tax, payroll, and GST/HST, saving our clients millions of dollars in potential reassessments, penalties, and interest.

Geographic Fluency: With multiple offices (Toronto, Mississauga, North York, Ajax), we have established relationships and familiarity with the specific regional CRA offices and the common audit tendencies in the Greater Toronto Area and surrounding regions.

Client-First Approach: Testimonials and Trust

We build trust through transparent communication and a singular focus on your goals. We understand that an audit is a personal crisis, and we treat it with the urgency and empathy it deserves.

Guaranteed Transparency: We operate on a clear, upfront engagement model. You will always know the strategy, the timeline, and the rationale behind every action we take. We provide regular updates and never make a move without your informed consent.

Dedication to Outcome: Our primary guarantee is our relentless pursuit of the best possible financial outcome for your case, guided by the highest ethical and professional standards. We fight for every dollar of relief you deserve.

Our Step-by-Step Process for Delivering Effective CRA Audit Assistance

Our successful track record is a result of a highly disciplined, systematic process. We eliminate guesswork and replace it with a focused, battle-tested approach to CRA audit assistance.

Step 1: The Rapid Response and Discovery Call

The moment you contact us, the clock starts. We conduct an immediate, confidential review of your CRA correspondence (e.g., audit letter, reassessment).

Action: We define the scope, identify the CRA’s core concerns, and immediately determine the critical deadlines.

Result: You gain clarity and an immediate cessation of stress, knowing a professional is now in control.

Step 2: Formal Engagement and CRA Handoff

Once engaged, we formally notify the CRA of our representation via a Form T1013, Authorizing or Cancelling a Representative.

Action: All future CRA contact is legally directed to PrimeTax Solutions. We establish the communication protocol and set the strategic tone for the defense.

Result: Zero contact from the CRA for you. We take the lead on all communications, scheduling, and information requests.

Step 3: Document Compilation, Review, and Strategy

This is the most time-intensive and critical phase. We do the heavy lifting of gathering, vetting, and preparing your evidence.

Action: We work closely with you to gather all source documents. We meticulously review them, cross-reference them against tax legislation, and compile a single, indexed evidence package designed to satisfy the CRA’s requirements and support your claims.

Result: A professional, persuasive document package that pre-empts common auditor questions and provides the strongest possible defense.

Step 4: Negotiation, Response, and Case Management

We manage the entire auditor relationship from beginning to end, ensuring your case is presented strategically.

Action: We submit the defense package, attend all necessary meetings (on your behalf), and engage in direct negotiation with the auditor to challenge findings, clarify ambiguous areas, and negotiate the final assessment.

Result: An efficiently managed audit process with negotiations aimed at minimizing tax liability and securing a positive resolution.

Step 5: Resolution, Finalization, and Post-Audit Review

The audit is complete, but our service is not.

Action: We review the final documentation (Notice of Assessment/Reassessment) to ensure all negotiated terms are accurately reflected. We then conduct a post-audit review to advise you on any necessary changes to your future record-keeping and tax strategy to prevent recurrence.

Result: A secure, final resolution, plus the knowledge and tools to ensure future compliance and peace of mind.

Investing in Your Protection: Pricing and Value of CRA Audit Assistance

While the cost of professional CRA audit assistance is an investment, it pales in comparison to the financial risk of facing the CRA alone. The consequences of an unfavorable audit outcome—reassessments, compound interest, and crippling penalties—can be catastrophic for both your personal wealth and the solvency of your business.

We structure our services to maximize value and transparency:

Fixed-Fee Initial Consultation: We begin with a low-cost, fixed-fee consultation to review your specific audit notice, assess the complexity, and provide a clear, initial strategy. This gives you peace of mind before any major financial commitment.

Customized Engagement Packages: Based on the scope of the audit (personal vs. corporate, number of years reviewed, type of tax), we provide a customized, clear, and comprehensive engagement package. This fixed-fee or capped-fee structure ensures you have cost certainty and there are no surprise hourly bills, allowing you to focus on your business while we focus on your defense.

Measurable Return on Investment (ROI): Our value is quantified by the taxes, interest, and penalties we prevent or reduce. In nearly all cases, the amount saved for our clients significantly outweighs the professional fees incurred. You are not buying a service; you are buying financial protection and the preservation of your assets.

Don’t focus on the expense of expert CRA audit assistance; focus on the cost of non-compliance, which can be 5 to 10 times higher than the cost of a professional defense.

Frequently Asked Questions (FAQ) About CRA Audit Assistance

We address the most common concerns regarding tax audits and how our CRA audit assistance service resolves them.

Q1: What exactly is a CRA audit, and what triggers one?

A CRA audit is a detailed review of your books and records to ensure you have fully reported your income and claimed only the deductions and credits to which you are entitled. Triggers are complex but often include significant fluctuations in reported income or expenses, continuous reporting of business losses, or a discrepancy in reported income compared to third-party sources (e.g., banks, other businesses). Regardless of the trigger, our CRA audit assistance starts with a strategic review of the audit notice to understand the CRA’s specific focus.

Q2: How long does the professional CRA audit assistance process take?

The duration of an audit varies dramatically depending on the complexity (e.g., personal vs. multi-year corporate review), the completeness of your documentation, and the auditor’s own workload. On average, a personal audit can take a few months, while a complex corporate audit can take six months to a year or more. Our CRA audit assistance is designed to minimize this timeline by providing the auditor with meticulously organized, high-quality information swiftly, which is the most effective way to expedite the resolution.

Q3: Can PrimeTax Solutions help with a Notice of Objection or Appeal?

Absolutely. If the CRA issues a Notice of Reassessment, our CRA audit assistance immediately shifts into the formal dispute resolution phase. Filing a Notice of Objection is a critical step, which we handle entirely. This involves preparing a detailed written submission to the Appeals Division, outlining the legal and factual errors in the auditor’s findings and citing relevant tax law. We manage the entire appeals process up to and including preparation for the Tax Court of Canada.

Q4: Why hire a professional for CRA audit assistance instead of doing it myself?

Facing a trained CRA auditor without professional representation can be financially detrimental. Auditors are not there to help you; they are there to verify compliance, which often results in maximizing the assessment. An in-house defense lacks objectivity and often results in providing the CRA with unnecessary information. Our experts offer:

Objectivity: We separate emotion from fact, presenting only the strongest arguments.

Procedural Knowledge: We know the CRA’s internal deadlines and procedures, ensuring compliance and preventing procedural errors that could invalidate your defense.

Negotiation Skill: Our team possesses the negotiation skills required to challenge unreasonable assumptions and limit the scope of the inquiry.

Q5: What types of audits do you offer CRA audit assistance for?

We offer comprehensive CRA audit assistance for virtually all types of tax audits, including:

Personal Income Tax Audits (T1)

Corporate Income Tax Audits (T2)

Goods and Services Tax / Harmonized Sales Tax (GST/HST) Audits

Payroll Audits (Source Deductions)

Scientific Research and Experimental Development (SR&ED) Audits

Non-Resident Audits

Take Control Today with Premier CRA Audit Assistance

Don’t wait for the audit process to take over your life and threaten your finances. The single most important action you can take right now to protect yourself and your business is to engage expert CRA audit assistance.

PrimeTax Solutions is ready to step in as your shield, your advocate, and your expert negotiator. We provide the experience, knowledge, and dedication needed to navigate the complexities of a tax audit and achieve the optimal outcome.

Your financial peace of mind starts here. Contact us immediately for a confidential consultation.